March 2025 Performance Review: How We Achieved 81% Returns (Full Breakdown)

March was a record-breaking month — here’s the good, the bad, and the lessons learned

March 2025 was an exceptional month for our trading portfolio, delivering a staggering 81.26% ROI. While the results were strong, we also encountered challenges that tested our discipline and strategy. In this post, we break down every major trade, performance metric, and key lesson so you can refine your own trading approach.

Performance Overview

Key Stats

- Total ROI: 81.26% (A significant growth over our previous months)

- Win Rate: 60.85% (Well above our target consistency threshold)

- Profit Factor: 1.58 (For every $1 risked, we made $1.58)

- Largest Drawdown: -$34.19 (A controlled dip that highlights effective risk management)

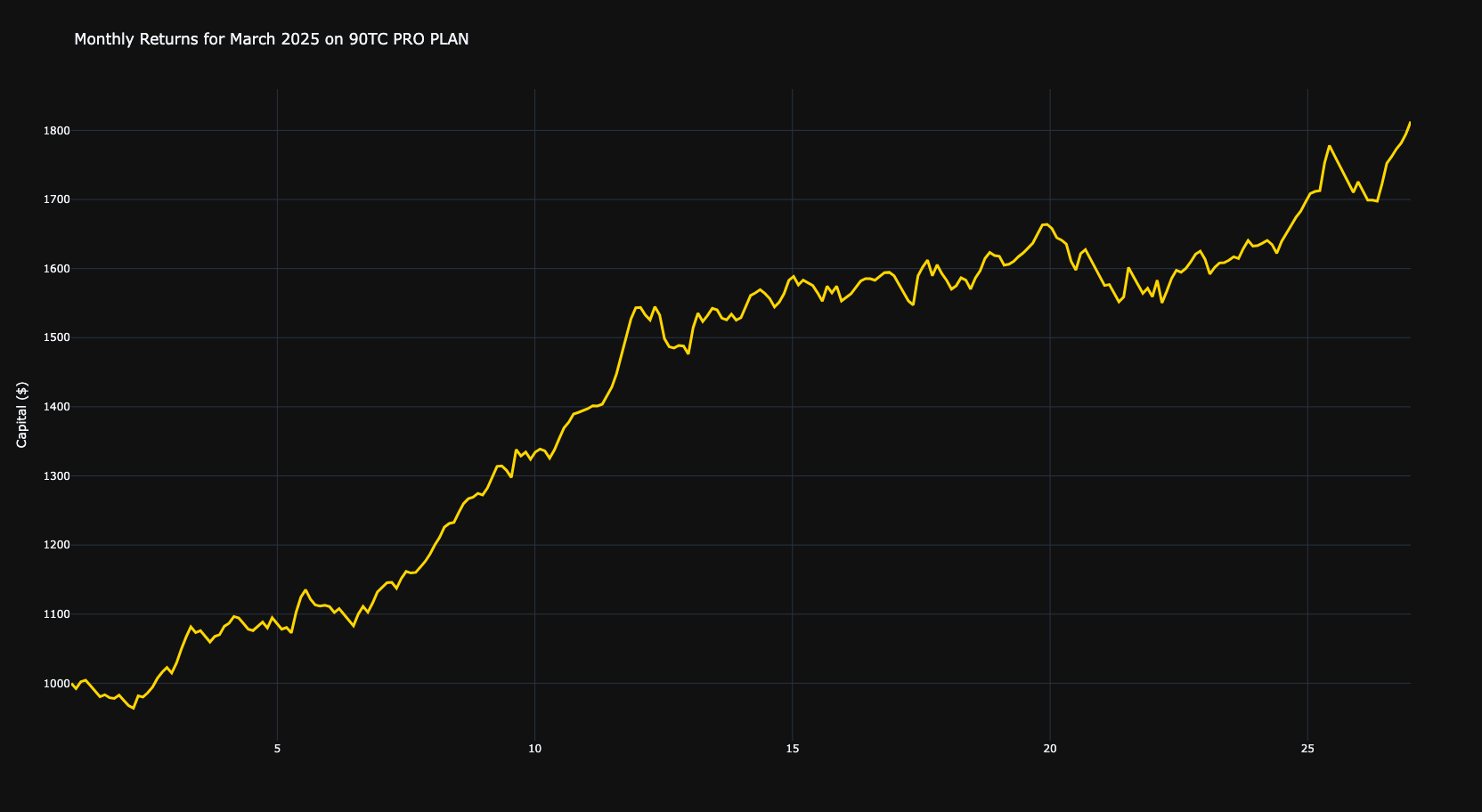

Equity Curve Analysis

Our equity curve showed steady growth with minimal deep drawdowns. The largest setback was a $34.19 decline, which was promptly recovered by the next sequence of trades.

Top Performers & Underperformers

Best Performing Pairs

-

GBPJPY: +$1,274.68 net profit, 62% win rate

- Why it worked: High volatility, trend-following setups, and strong momentum trading.

-

CADCHF: Consistent profitability

- What we got right: Favorable news events and breakout trades aligned with our strategy.

Underperformers

-

CADJPY: Only +$8.08 profit

- Issue: Choppy price action during uncertain conditions.

-

EURGBP: +$5.02 net profit

- Issue: Range-bound movement that didn’t favor our breakout strategies.

Trade Analysis: Wins, Losses, and Lessons

Largest Winning Trade: GBPJPY (+301 pips)

- Strategy: Bullish breakout following Bank of Japan intervention.

- Execution: Entry at key support level, with trailing stops to maximize profit.

- Key Takeaway: Patience paid off; the trend confirmation was crucial.

Largest Losing Trade: GBPJPY (-130 pips)

- Mistake: Ignored overbought RSI signals, leading to a reversal.

- Solution: More disciplined entry criteria and confirmation indicators.

Behavioral Patterns

- Revenge Trading? No major issues, but slight overtrading in slow conditions.

- Risk Discipline? Maintained a 1:1.9 risk-to-reward ratio, which helped sustain profitability.

Risk & Strategy Deep Dive

Time-Based Insights

- Trades executed between 12:00–16:00 UTC had a 63% win rate.

- Post-midnight trades fell to a 48% win rate, suggesting lower liquidity impact.

Volatility’s Role

- GBPJPY & CADJPY accounted for 68% of our profits, but they required tighter stop losses due to their rapid movements.

Actionable Takeaways

For Readers

- Focus on high-probability setups like the GBPJPY breakout.

- Avoid low-liquidity trading hours (post-midnight sessions).

- Adapt to volatility — some pairs require different stop-loss placements.

For Our Team

- Refine USDCAD strategy: Reduce position size or avoid trading during low-volatility periods.

- Monitor GBPJPY overbought conditions: Use additional indicators to confirm trade setups.

Conclusion

We’re proud of this month’s success but remain focused on improving further.

Want our April trade plan? Subscribe for early access and stay ahead of the market!

90tradingclub.com

Upcoming Improvements

- Equity curve visualization

- Profit distribution by currency pair (pie chart)

- Win-rate heatmap by hour/day